1 Obtain The Air BNB Invoice. In some locations Airbnb has made agreements with government officials to collect and remit certain local taxes on behalf of Hosts.

Airbnb Your Payment Receipt 2 Pdf Your Receipt From Airbnb Receipt Id Rckp2hwsre Nov 28 2019 Wanhua District Price Breakdown 1 Night In Wanhua Course Hero

Guests who book Airbnb listings that are located in the Country of India will pay the following taxes as part of their reservation.

. A Value Added Tax VAT invoice is provided whenever VAT is assessed on Airbnb service fees. India Goods and Services Tax. Your invoice is finalised and issued when a reservation is accepted and includes your information name address etc as you entered it in your Airbnb account.

It applies more or less to all goods and services that are bought and sold for use or consumption. Effective 1 September 2017 foreign nationals who stay at an accommodation premise in Malaysia are subject to a tourism tax of RM10 per room per night. The tourism tax which came into effect in September last year charges a flat rate of RM10 per room per night for foreigners who stay at hotels of all classes.

Check with the Inland Revenue Board Malaysia to find out if you need to declare the amount you earn from hosting which you can find in your host earnings summary. When you book a listing in one of these. Go to the receipt instruction above Scroll down to Go to Payment Details to view VAT Invoice.

If you have a VAT ID number you can associate it with your Airbnb account. Airbnb VAT applies only to the service fee. There is potential criminal liability such as financial penalties andor imprisonment for carrying on business under a business name without being registered in respect of that name.

Malaysians and permanent residents of Malaysia are exempted from paying the tourism tax. If you are applying discounts first booking monthly stay one night off etc or an Airbnb coupon include it in this section subtracting the discountedcoupon amount from the subtotal before. Keep records of all your income and expenses.

Hosts must be Malaysian or Malaysian Permanent Resident. As such locals renting Airbnbs will probably be exempt from having to pay the tax. There are a few instances where an Airbnb guest may need to pay tax.

There are 3 different types of classifications for short term rental airbnbs. Airbnb is not able to modify a VAT invoice after its been issued. Yes of course we should have tax across the board Mike Orgill its South-east Asia Hong Kong and Taiwan.

Hosted Un-hosted Hybrid and commercial. Disclose all you Airbnb income in your tax return and make sure you claim all the deductions you are entitled to. Annual net profits taxable income minus deductible expenses are subject to corporate income tax at the prevailing rate of up to 24 percent.

You can get your VAT invoice from the billing receipt. The taxes vary and may include calculations based on a flat rate or percentage rate number of guests number of nights or property type booked depending on local law. The ATO may ask to see them particularly if they query an expense.

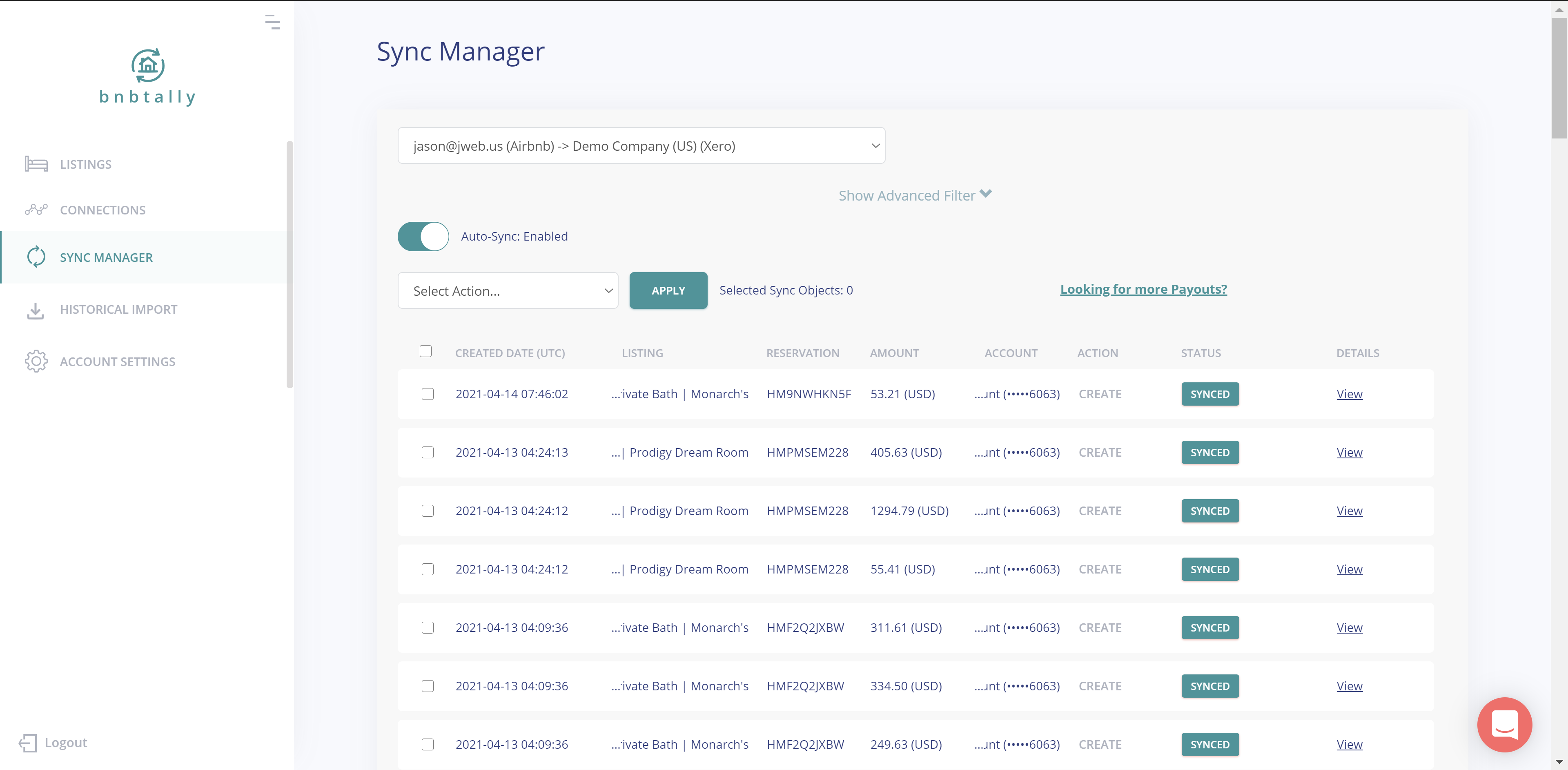

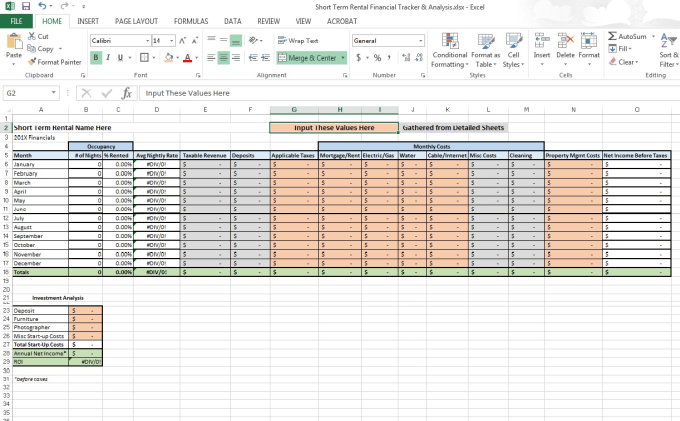

KUALA LUMPUR July 2 Airbnb said today it welcomes Putrajayas proposal to tax its services along with other online firms but pressed for a fair structure amid growing scrutiny over the Singapore-based firms revenue. The Air BNB invoice is downloadable as a spreadsheet that you may edit with your copy of Excel. The totals section of your Airbnb invoice template must have a few lines to specify the amount due before taxes subtotal then add the applicable taxes and state the final amount due.

The Business Company and I shall indemnify and keep indemnified MAB in full and on demand from and against all and any losses costs expenses penalties legal suits faced suffered or. The document preview on this page is accompanied by an Excel button that you may use to download this file. In your reservation details youll find an option to print.

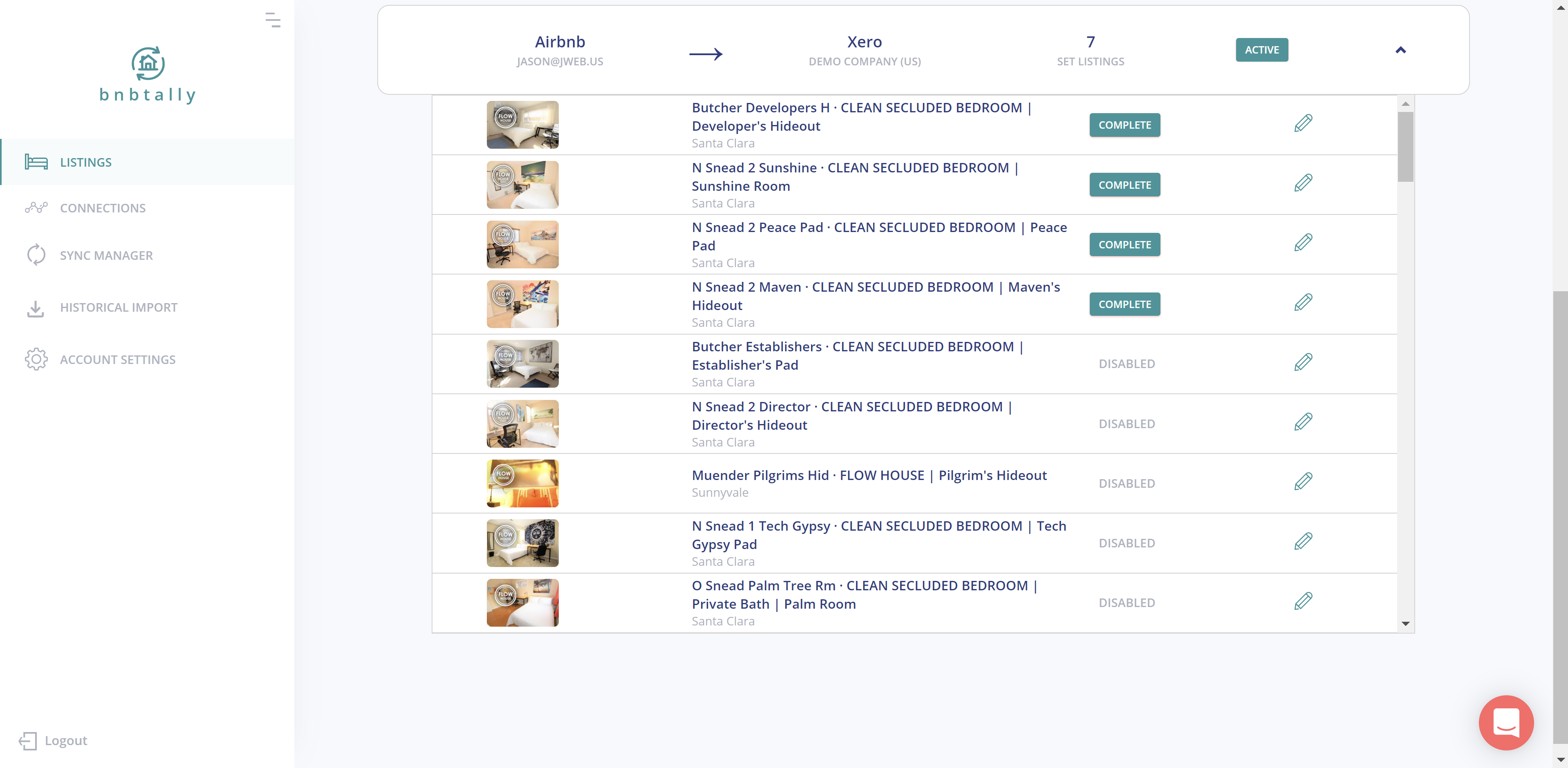

You can go to your Trips to find a receipt for a completed stay. In other words if you dont book with a host thats vat registered you cannot get a vat invoice for the accommodation. Accommodations must have Certificate of Compliance and Completion CCC and must not be subsidized government housing PPR PR1MA etc 3.

The VAT invoice will only show the amount of the service fees paid. Has agreed to work with Malaysia on tax collection with initial efforts to focus on a tourism levy as the government prepares to cast a wider net on the digital economy. All groups and messages.

I further agree and confirm that the Business Company or I will not claim input tax from the original Tax Invoice that was issued by Malaysia Airlines Berhad MAB during the purchase. Consider getting a quantity surveyors report to maximise your depreciation deductions. Add your VAT ID number.

5 of hosts are vat registered and would have a business listing with company details and issue you a vat invoice. The San Francisco-based home-sharing company is moving to finalize a deal with tax authorities which will apply a new tourism tax of 10 ringgit 255 per night to Airbnb members who rent out. However Goh added that there is no time frame for the implementation of the VCA yet as the discussion is still ongoing.

Your billing receipt is based on the info you provide at the time of booking and it cant be edited after it was issued. Click on Go to VAT Invoice. Business listings have a tiny bit extra under the Contact host button as per picture.

While it seems like the implementation of tourism tax only affects foreigners in the country with more and more. Similarly the Microsoft Excel xlsx link above will give you access to the same file. In Japan there is a similar tax called the Japanese Consumption Tax.

Value Added Tax or VAT is a tax assessed on the supply of goods and services. The Value-Added Tax or VAT in the European Union China and many other countries is a general broadly based consumption tax assessed on the value added to goods and services. You can make changes in your account settings.

0 - 18 of the accommodation charge including any cleaning fee. Hosts and guests can access their VAT invoices in their Airbnb account. You will be required to register your business with the Companies Commission of Malaysia CCM before carrying on business in Malaysia.

Tax rates vary based on the average nightly rate of the reservation.

How To Change Currency On Airbnb Website App

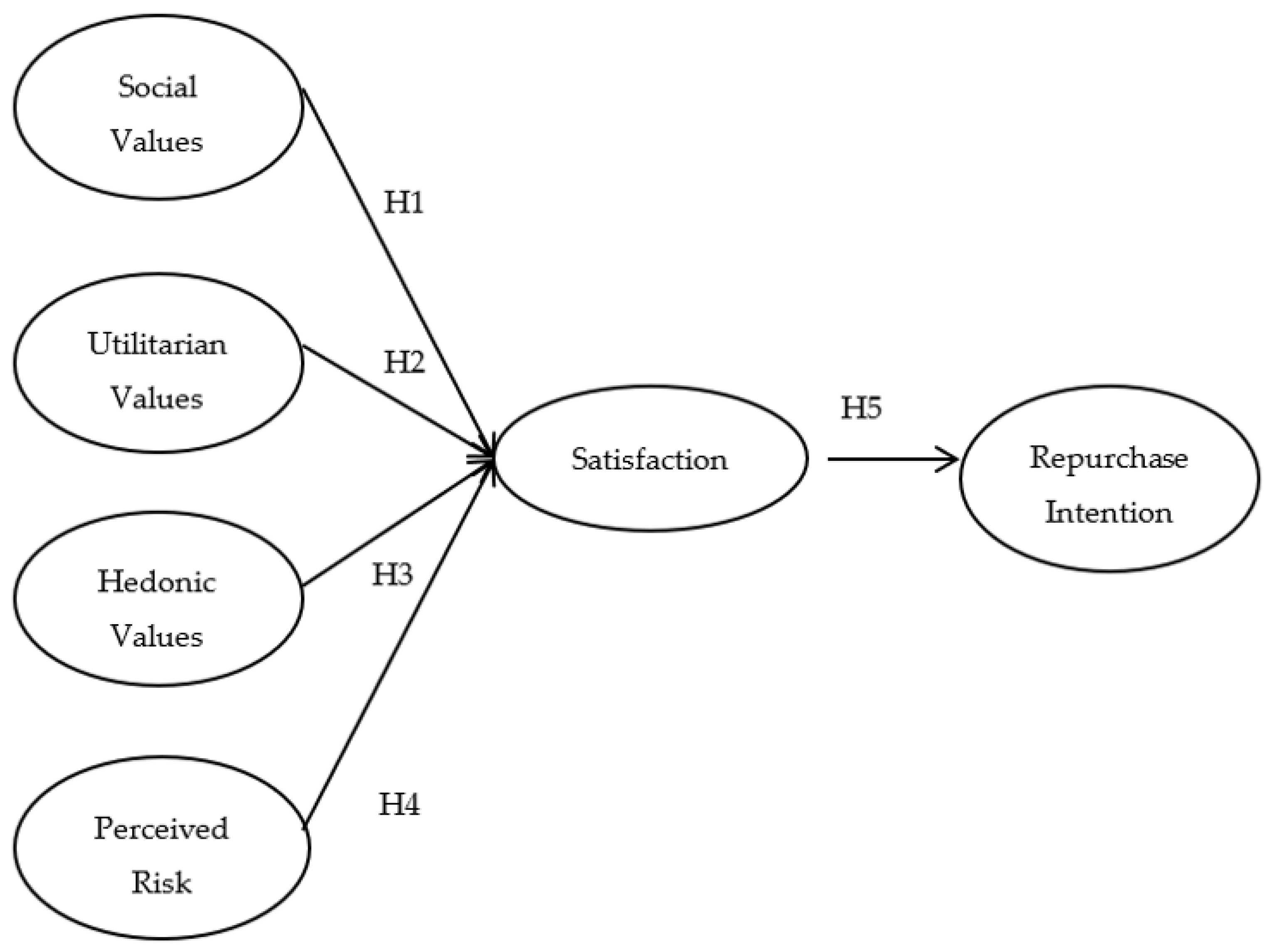

Sustainability Free Full Text Airbnb Hospitality Exploring Users And Non Users Perceptions And Intentions Html

How To Change Currency On Airbnb Website App

Provide You An Airbnb Rental Analysis Spreadsheet By Reedmitchell7 Fiverr

How To Change Currency On Airbnb Website App

Receipt Airbnb Pdf Airbnb Payments

Italian Airbnb Tax Studio Legale Metta

Miron Costin Vacation Rentals Homes Botoșani County Romania Airbnb

Airbnb Rental Invoice Template Invoice Template Receipt Template Airbnb Rentals

How To Change Currency On Airbnb Website App

How To Change Currency On Airbnb Website App

Receipt Airbnb Pdf Airbnb Payments

Receipt Airbnb Pdf Airbnb Payments